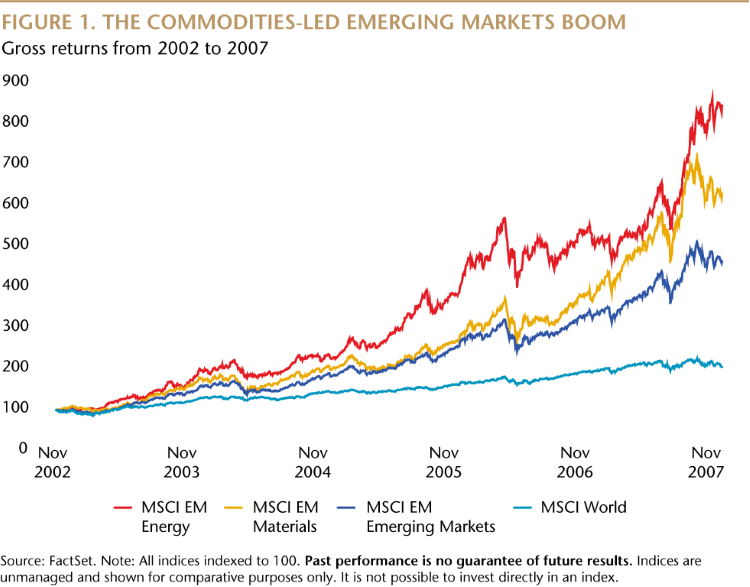

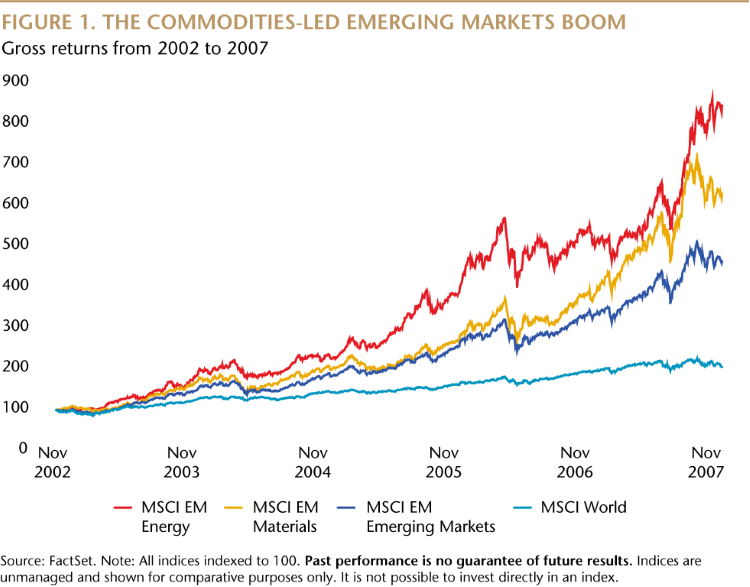

Remember the commodities boom? It was the bull market of the early 2000s that was largely propelled by the emerging markets. It also helped those economies become a critical component of the balanced portfolios that we know today.

The boom showed the latent power and long-term potential of emerging markets and highlighted the value of the asset class for equity investors. One challenge to be mindful of, however, particularly when it comes to long-term secular opportunities, is that growth in emerging markets can be extreme and narrowly focused. And after the boom, the future expansion of some markets can seem ordained in a certain direction.

The market rally of the 2000s, for example, was essentially a commodities-led boom for emerging markets in Asia, Latin America and elsewhere, and closely tied to resources-intensive sectors, like energy and materials. More than 20 years later, many emerging economies either remain focused in commodities or their industries remain heavily dependent on fossil fuels.

Now, as the world tries to carve out a sustainable, low-carbon path, these old economy traits undoubtedly present a systemic challenge. As environmental, social and governance (ESG) considerations have become increasingly critical for investors and portfolio managers, many emerging markets, seen through a sustainable lens, have found themselves lagging the progress of much of the developed world. Investors, in turn, have found themselves unsure of how best to think about effective, sustainable emerging markets exposure in their portfolios.

While it is inarguable emerging markets have ample work to transition their economies onto a sustainable footing, we also believe this gap with the developed world introduces a tremendous investment opportunity. It raises the possibility that the next emerging markets-led bull market could be as powerful as the rally two decades ago though this time, powered by companies on the leading edge of crafting a global sustainable future.

The Sustainable Potential of Emerging Markets

In the early 21st century, a group of emerging markets comprising Brazil, Russia, India, China and South Africa—collectively known as the BRICS—rose to prominence thanks to the strength of their domestic, resources-driven companies. These markets have since remained reliant on both traditional, heavy industry and primarily coal-fired power. As the world moves toward a low-carbon future, these nations and other emerging markets will need to effect major economic shifts.

„The next emerging markets-led bull market could be as powerful as the rally two decades ago—though this time, powered by companies on the leading edge of crafting a sustainable future.” – Kathlyn Collins, Head of Responsible Investment and Stewardship

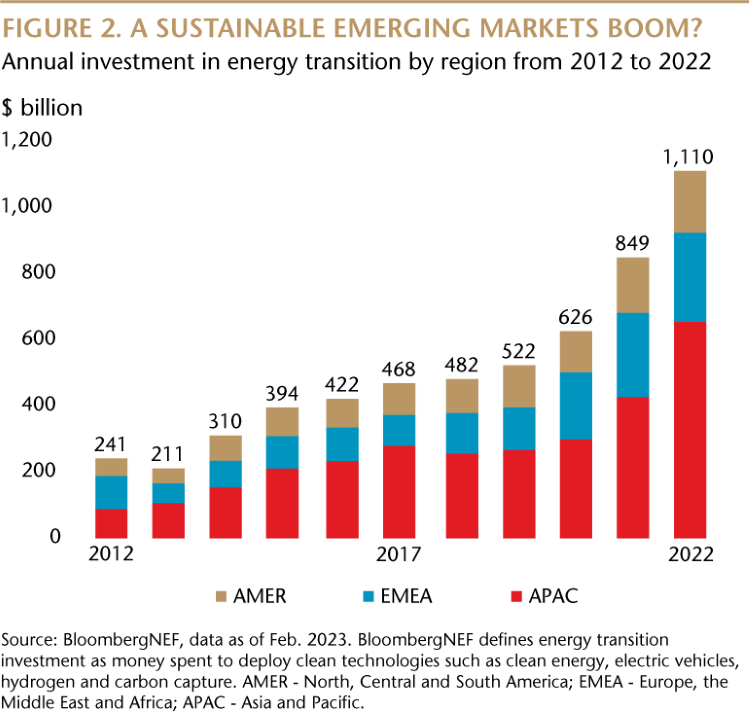

These transitions will require economies to either change their entire energy mix by shifting from old industry to new secular industrial drivers, such as 5G, big data and electric vehicles, or increase the economic role of services industries, which tend to be less carbon-intensive. Pursuing either of these transitions, or a combination of both, introduces the possibility of an early 2000s-like intensive growth phase for some emerging markets in the future, in our view.

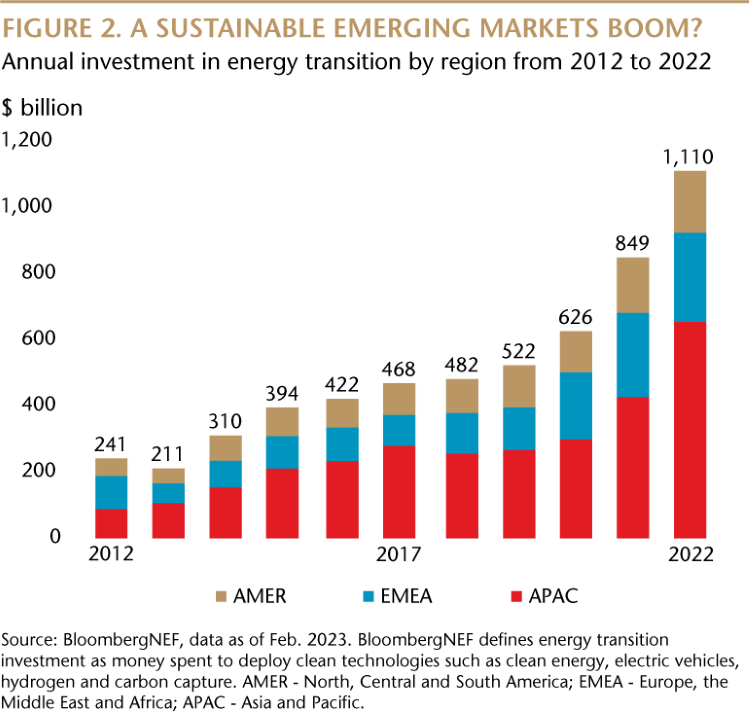

The scale of the sustainable transitions facing emerging markets is significant. For example, achieving the cumulative reduction in fossil fuel reliance which countries globally have committed to in multilateral climate-related pledges is heavily reliant on technologies not currently commercially available. These technologies will require innovative companies and massive capital investments in order to meet targets like those outlined in the UN Sustainable Development Goals (SDG), which call for an estimated $5 trillion to $7 trillion annual investment.

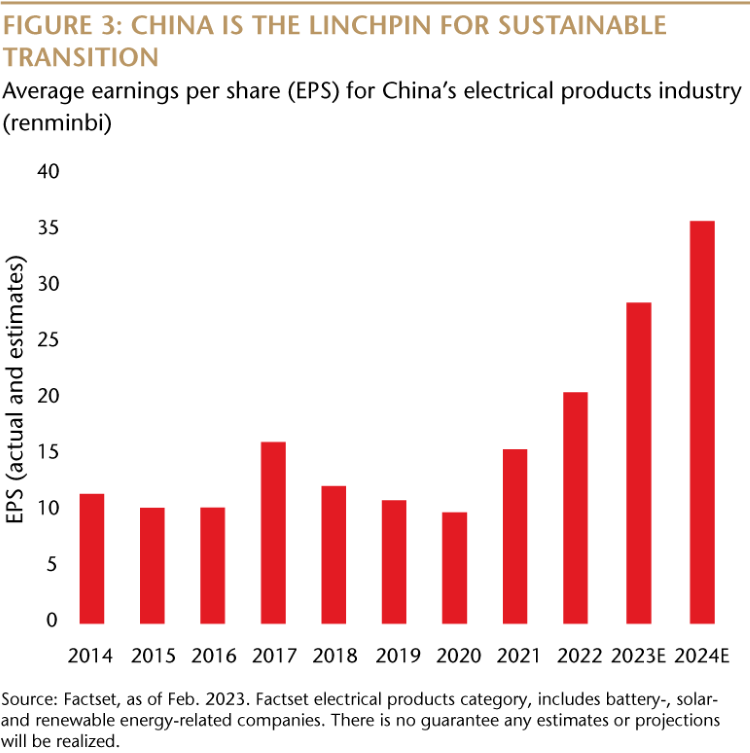

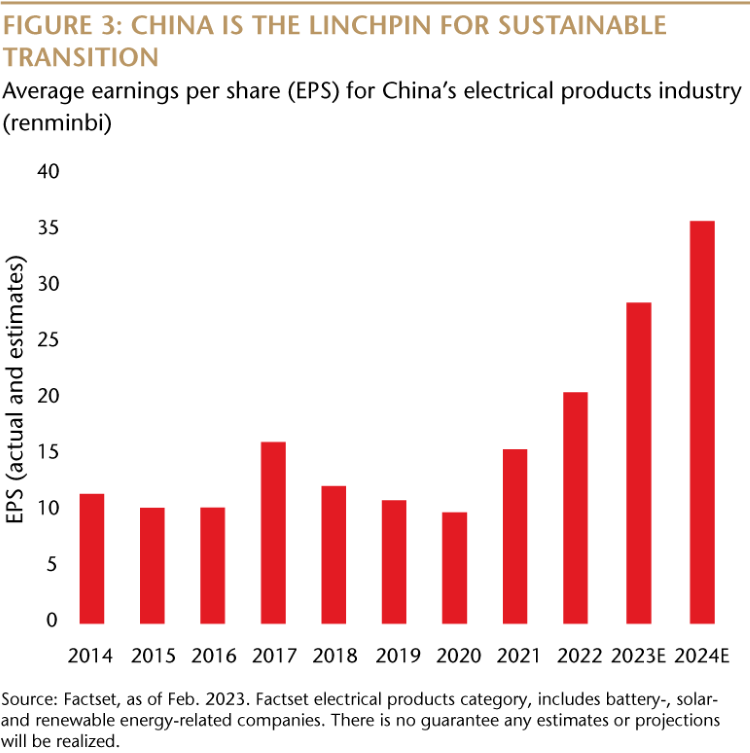

China Is the Linchpin

China represents the linchpin for sustainable change in emerging markets. Its economy is heavily coal-fired and for decades it has led Asia to generate nearly 90% of global carbon emissions growth. For China to decarbonize its economy it will need to become less reliant on industry and for industry to become less reliant on coal. As things currently stand, cement, steel, infrastructure and overall industrial output are China’s main economic drivers and power generation and industrial activity account for some 75% of China’s emissions. While there has been a recent, modest shift away from old industry and toward new enterprise, the impact on China’s emissions is a long way from being noticeable or noteworthy. And regardless of whether China hastens to newer, less energy-intensive industry or attempts to shift to a more services-oriented economy, it will first have to increase its supply of clean power as its power grid currently doesn’t accommodate enough renewables to meet its energy demand.

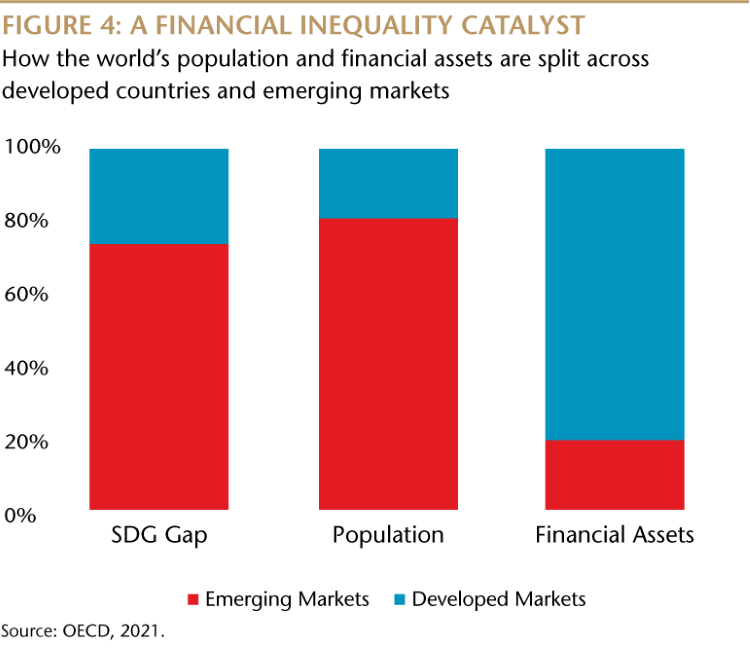

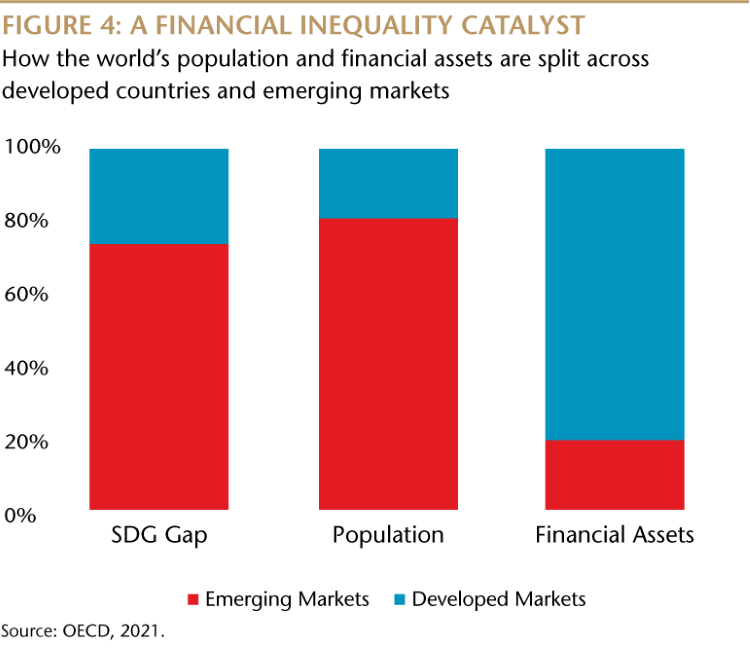

The world needs emerging markets to transition to a sustainable footing in order to realize global goals for a low-carbon future. And the transition isn’t just about the environment. It is also about addressing socioeconomic issues such as inequality, which was intensified by the COVID-19 pandemic. Inequality is acutely felt in emerging countries as they tend to have large informal economic sectors, greater regional differences in wealth levels, wider educational access gaps and higher barriers to employment for women.

Financial Inclusion Gap

This inequality is exacerbated by a financial inclusion gap between the developed and emerging worlds. The reality is most of the globe’s financial assets are in developed countries while the majority of world’s population and most of the UN’s SDG funding gap is in emerging markets. Large sections of the populations in many emerging markets across Asia, Africa and Latin America still lack access to basic banking services, hampering their economic development, wealth generation, and progress toward developing industries and services for a sustainable future.

Similarly to addressing environmental issues, addressing financial exclusion will be a formidable task and will require a significant shift in resources from developed markets to the emerging world in order for emerging markets to meet their challenges for the benefit of the world and their own populations. But it will also provide a growth catalyst and a potentially sizeable opportunity for innovative companies and well-positioned investors in the years and decades ahead. Addressing these challenges will introduce windows for investors to provide capital to innovative companies seeking to narrow—and ultimately close—these gaps.

Active, Balanced Exposure

To get an enduring and balanced exposure to these potentially gigantic trends we believe investors should take an informed approach using a diversified, well-researched strategy that views emerging markets in Asia and throughout the world with a long-term sustainable lens—rather than targeting exposures to specific sectors and markets.

An active approach is also key. It requires proprietary, on-the-ground research as well as in-depth knowledge of the local markets, the challenges they face—whether environmental issues like water scarcity or regulatory issues like corruption—and where they already are in terms of progress on sustainability-related considerations.

The ability to conduct such research is heavily reliant on portfolio managers with the experience—both broad and deep—to recognize these shifts and, of course, capitalize on them. In our view, a balanced and active approach offers investors the best platform for anticipating and leveraging what we believe will be a long-term and powerful growth period in the sustainable assets of emerging markets.

Portfolio Perspectives

- Successfully investing in emerging markets involves not just choosing quality companies within growing markets and industries, but also attempting to avoid risks associated with unanticipated government policies, regulatory oversight and geopolitical considerations. Sustainable strategies can help mitigate these risks through thoughtful stock selection and an approach which can align with government policies.

- For investors with existing emerging markets exposure, sustainable emerging markets investments can act as a complement. The key to ensuring sufficient diversification is evaluating existing holdings in terms of exposure to market caps, sectors, countries, and growth versus value, and then selecting a sustainable emerging markets strategy that offers alternative exposures. For example, an investor with a passive emerging markets exchange traded fund (ETF) or a more value, cyclically-oriented emerging markets fund could benefit from a small- or mid-cap, growth-oriented sustainable strategy.

Kathlyn Collins

Head of Responsible Investment and Stewardship

Matthews Asia

Definitions:

MSCI Emerging Markets (EM) Energy Index and MSCI Emerging Markets (EM) Materials Index include large- and mid-cap securities classified in the Energy and Materials sectors respectively, per Global Industry Classification Standard (GICS), across 24 Emerging Markets countries.

MSCI Emerging Markets (EM) Index captures large- and mid-cap securities across 24 Emerging Markets countries.

MSCI World Index captures large and mid-cap representation across 23 Developed Markets countries.

Disclosures and Notes

ESG considerations are not a specific requirement for all portfolios at Matthews Asia. ESG factors can vary over different periods and can evolve over time. They may also be difficult to apply consistently across regions, countries or sectors. There can be no assurance or guarantee that a company deemed to meet ESG standards will actually conduct its affairs in a manner that is less destructive to the environment, or promote positive social and economic developments than a company that does not meet ESG standards.

Investments involve risk. Investing in international, emerging and frontier markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in Chinese securities involve risks. Heightened risks related to the regulatory environment and the potential actions by the Chinese government could negatively impact performance. Additionally, investing in emerging and frontier securities involves greater risks than investing in securities of developed markets, as issuers in these countries generally disclose less financial and other information publicly or restrict access to certain information from review by non-domestic authorities. Emerging and frontier markets tend to have less stringent and less uniform accounting, auditing and financial reporting standards, limited regulatory or governmental oversight, and limited investor protection or rights to take action against issuers, resulting in potential material risks to investors. Pandemics and other public health emergencies can result in market volatility and disruption.

Important Information

There is no guarantee any estimates or projections will be realized.

Remember the commodities boom? It was the bull market of the early 2000s that was largely propelled by the emerging markets. It also helped those economies become a critical component of the balanced portfolios that we know today.

The boom showed the latent power and long-term potential of emerging markets and highlighted the value of the asset class for equity investors. One challenge to be mindful of, however, particularly when it comes to long-term secular opportunities, is that growth in emerging markets can be extreme and narrowly focused. And after the boom, the future expansion of some markets can seem ordained in a certain direction.

The market rally of the 2000s, for example, was essentially a commodities-led boom for emerging markets in Asia, Latin America and elsewhere, and closely tied to resources-intensive sectors, like energy and materials. More than 20 years later, many emerging economies either remain focused in commodities or their industries remain heavily dependent on fossil fuels.

Now, as the world tries to carve out a sustainable, low-carbon path, these old economy traits undoubtedly present a systemic challenge. As environmental, social and governance (ESG) considerations have become increasingly critical for investors and portfolio managers, many emerging markets, seen through a sustainable lens, have found themselves lagging the progress of much of the developed world. Investors, in turn, have found themselves unsure of how best to think about effective, sustainable emerging markets exposure in their portfolios.

While it is inarguable emerging markets have ample work to transition their economies onto a sustainable footing, we also believe this gap with the developed world introduces a tremendous investment opportunity. It raises the possibility that the next emerging markets-led bull market could be as powerful as the rally two decades ago though this time, powered by companies on the leading edge of crafting a global sustainable future.

The Sustainable Potential of Emerging Markets

In the early 21st century, a group of emerging markets comprising Brazil, Russia, India, China and South Africa—collectively known as the BRICS—rose to prominence thanks to the strength of their domestic, resources-driven companies. These markets have since remained reliant on both traditional, heavy industry and primarily coal-fired power. As the world moves toward a low-carbon future, these nations and other emerging markets will need to effect major economic shifts.

„The next emerging markets-led bull market could be as powerful as the rally two decades ago—though this time, powered by companies on the leading edge of crafting a sustainable future.” – Kathlyn Collins, Head of Responsible Investment and Stewardship

These transitions will require economies to either change their entire energy mix by shifting from old industry to new secular industrial drivers, such as 5G, big data and electric vehicles, or increase the economic role of services industries, which tend to be less carbon-intensive. Pursuing either of these transitions, or a combination of both, introduces the possibility of an early 2000s-like intensive growth phase for some emerging markets in the future, in our view.

The scale of the sustainable transitions facing emerging markets is significant. For example, achieving the cumulative reduction in fossil fuel reliance which countries globally have committed to in multilateral climate-related pledges is heavily reliant on technologies not currently commercially available. These technologies will require innovative companies and massive capital investments in order to meet targets like those outlined in the UN Sustainable Development Goals (SDG), which call for an estimated $5 trillion to $7 trillion annual investment.

China Is the Linchpin

China represents the linchpin for sustainable change in emerging markets. Its economy is heavily coal-fired and for decades it has led Asia to generate nearly 90% of global carbon emissions growth. For China to decarbonize its economy it will need to become less reliant on industry and for industry to become less reliant on coal. As things currently stand, cement, steel, infrastructure and overall industrial output are China’s main economic drivers and power generation and industrial activity account for some 75% of China’s emissions. While there has been a recent, modest shift away from old industry and toward new enterprise, the impact on China’s emissions is a long way from being noticeable or noteworthy. And regardless of whether China hastens to newer, less energy-intensive industry or attempts to shift to a more services-oriented economy, it will first have to increase its supply of clean power as its power grid currently doesn’t accommodate enough renewables to meet its energy demand.

The world needs emerging markets to transition to a sustainable footing in order to realize global goals for a low-carbon future. And the transition isn’t just about the environment. It is also about addressing socioeconomic issues such as inequality, which was intensified by the COVID-19 pandemic. Inequality is acutely felt in emerging countries as they tend to have large informal economic sectors, greater regional differences in wealth levels, wider educational access gaps and higher barriers to employment for women.

Financial Inclusion Gap

This inequality is exacerbated by a financial inclusion gap between the developed and emerging worlds. The reality is most of the globe’s financial assets are in developed countries while the majority of world’s population and most of the UN’s SDG funding gap is in emerging markets. Large sections of the populations in many emerging markets across Asia, Africa and Latin America still lack access to basic banking services, hampering their economic development, wealth generation, and progress toward developing industries and services for a sustainable future.

Active, Balanced Exposure

To get an enduring and balanced exposure to these potentially gigantic trends we believe investors should take an informed approach using a diversified, well-researched strategy that views emerging markets in Asia and throughout the world with a long-term sustainable lens—rather than targeting exposures to specific sectors and markets.

An active approach is also key. It requires proprietary, on-the-ground research as well as in-depth knowledge of the local markets, the challenges they face—whether environmental issues like water scarcity or regulatory issues like corruption—and where they already are in terms of progress on sustainability-related considerations.

The ability to conduct such research is heavily reliant on portfolio managers with the experience—both broad and deep—to recognize these shifts and, of course, capitalize on them. In our view, a balanced and active approach offers investors the best platform for anticipating and leveraging what we believe will be a long-term and powerful growth period in the sustainable assets of emerging markets.

Portfolio Perspectives

- Successfully investing in emerging markets involves not just choosing quality companies within growing markets and industries, but also attempting to avoid risks associated with unanticipated government policies, regulatory oversight and geopolitical considerations. Sustainable strategies can help mitigate these risks through thoughtful stock selection and an approach which can align with government policies.

- For investors with existing emerging markets exposure, sustainable emerging markets investments can act as a complement. The key to ensuring sufficient diversification is evaluating existing holdings in terms of exposure to market caps, sectors, countries, and growth versus value, and then selecting a sustainable emerging markets strategy that offers alternative exposures. For example, an investor with a passive emerging markets exchange traded fund (ETF) or a more value, cyclically-oriented emerging markets fund could benefit from a small- or mid-cap, growth-oriented sustainable strategy.

Kathlyn Collins

Head of Responsible Investment and Stewardship

Matthews Asia

Definitions:

MSCI Emerging Markets (EM) Energy Index and MSCI Emerging Markets (EM) Materials Index include large- and mid-cap securities classified in the Energy and Materials sectors respectively, per Global Industry Classification Standard (GICS), across 24 Emerging Markets countries.

MSCI Emerging Markets (EM) Index captures large- and mid-cap securities across 24 Emerging Markets countries.

MSCI World Index captures large and mid-cap representation across 23 Developed Markets countries.

Disclosures and Notes

ESG considerations are not a specific requirement for all portfolios at Matthews Asia. ESG factors can vary over different periods and can evolve over time. They may also be difficult to apply consistently across regions, countries or sectors. There can be no assurance or guarantee that a company deemed to meet ESG standards will actually conduct its affairs in a manner that is less destructive to the environment, or promote positive social and economic developments than a company that does not meet ESG standards.

Investments involve risk. Investing in international, emerging and frontier markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in Chinese securities involve risks. Heightened risks related to the regulatory environment and the potential actions by the Chinese government could negatively impact performance. Additionally, investing in emerging and frontier securities involves greater risks than investing in securities of developed markets, as issuers in these countries generally disclose less financial and other information publicly or restrict access to certain information from review by non-domestic authorities. Emerging and frontier markets tend to have less stringent and less uniform accounting, auditing and financial reporting standards, limited regulatory or governmental oversight, and limited investor protection or rights to take action against issuers, resulting in potential material risks to investors. Pandemics and other public health emergencies can result in market volatility and disruption.

Important Information

There is no guarantee any estimates or projections will be realized.